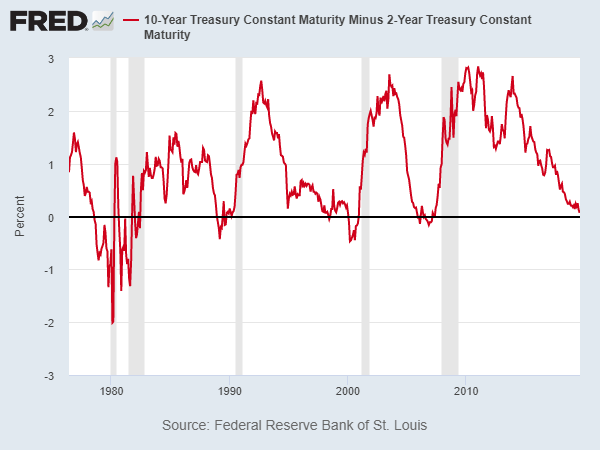

Yield Inversion - Early Recession signal

Related articles: CNBC, Yahoo Finance, Inverstors

Trade war - What's new?

The economic war between the United States and China has been a reality for over a year. On the 6th of July 2018, US Customs began collecting a 25 % tariff on 818 imported Chinese products valued at US 34$ billion. This was the first real sight into what is now a full-blown trade war.

The trade war has escalated this week with China announcing the new US 75$ billion tariff on US goods, excepted to affect the automobile and agriculture industries. Later this week, President Trump tweeted that the US would increase tariffs scheduled to begin on September 1st from 5 to 10 percent and tariffs scheduled to begin on October 1st from 25 to 30 percent.

Markets reacted poorly, with the S&P 500 down 2.59 % on Friday. Since the beginning of the trade war, the markets have been very volatile. Even though the economy in the US is doing fine, the S&P 500 is only up 3.35 % since the trade war started (see picture to the right).

Total US tariffs applied exclusively to Chinese goods: US$250 billion

Total Chinese tariffs applied exclusively to US goods: US$185 billion

Related articles: China Briefing, Bloomberg