Is 2% growth in GDP really considered growth?

Growth in the U.S. economy is critical to keep the economy out of a recession. Investors and economists have feared a recession would happen in the near future. U.S. Gross Domestic Product (GDP) is a measure of the market value of all goods manufactured within the United State’s borders. This useful statistic for investors and economists allows them to compare such numbers to understand how the economy is doing as a whole. Calculated and released every three months (quarterly), the Federal Reserve is in charge of informing the public about the current state of the economy.

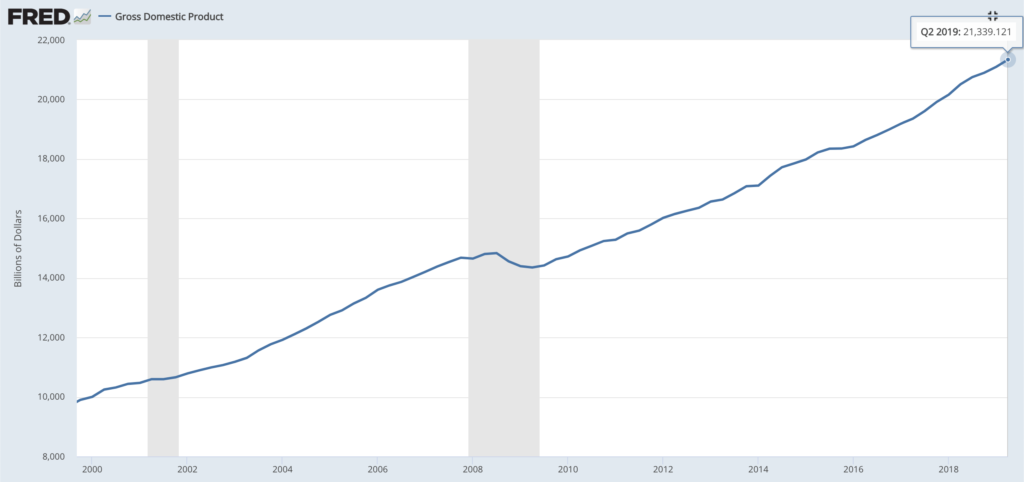

Last Thursday, August 29th, the government stated that GDP had risen 2% through April to June of 2019. Previously, the government had predicted a 2.1% increase in GDP for Q2, but the 2% was merely an upset in the eyes of investors.

Since the economy’s overall growth did not meet its expectations, we can draw a few hypotheses from the Federal Reserve’s statements last week. First, we can see that the economy is slowing down. Although there is still growth in GDP, the economy is still not meeting expectations, which means this is liable to happen again in the future.

If the economy were to bring negative returns in GDP, this would show the leading signs of a recession. By technical definition, a recession is defined as two consecutive quarters with negative growth of GDP. If the slowing economy slows down enough to the point where there will be negative growth, a recession will finally break the longest streak in U.S. economic growth.

As seen in the chart above, the U.S. GDP has been consistently rising in the 21st century. Despite than the two gray areas represented in 2001 and 2008. These gray areas represent times of recession or two or more consecutive quarters of negative growth in the economy.

If the U.S. manufacturing markets were to continue to slow down, this could lead to the next recession and ultimately put the economy through another tough time.

Read more about it:

U.S. economy slowing, but consumers limiting downside

Click the image to view the interactive chart on the St. Louis Federal Reserve Economic Data site.

If you are at all interested in becoming a Junior Analyst in any sector, please apply here. This will give you many opportunities to help out the club research for investments in the portfolio. All levels of experience are welcome, so do not be afraid to apply. You will have to submit a resume’ along with your application, and you will go through an interview with your prospective Director(s). If there are any questions about the position, please do not hesitate to reach out to any of the club’s Board Members!