World Banks Adopt New Climate Change Principles

According to Reuters News, banks with more than $47 trillion in assets, or a third of the global industry, adopted new U.N.-backed “responsible banking” principles to fight climate change on Sunday that would shift their loan books away from fossil fuels”. Among these banks are Citi Group and Deutsche Bank.This announcement was made by the United Nations Environment Progamme Finance Initiative, before the United Nations General Assembly this upcoming week. This assembly was aimed at policies and initiatives to curb the current climate change effects. Most of the policies are based upon the Paris Climate Agreement of 2015.

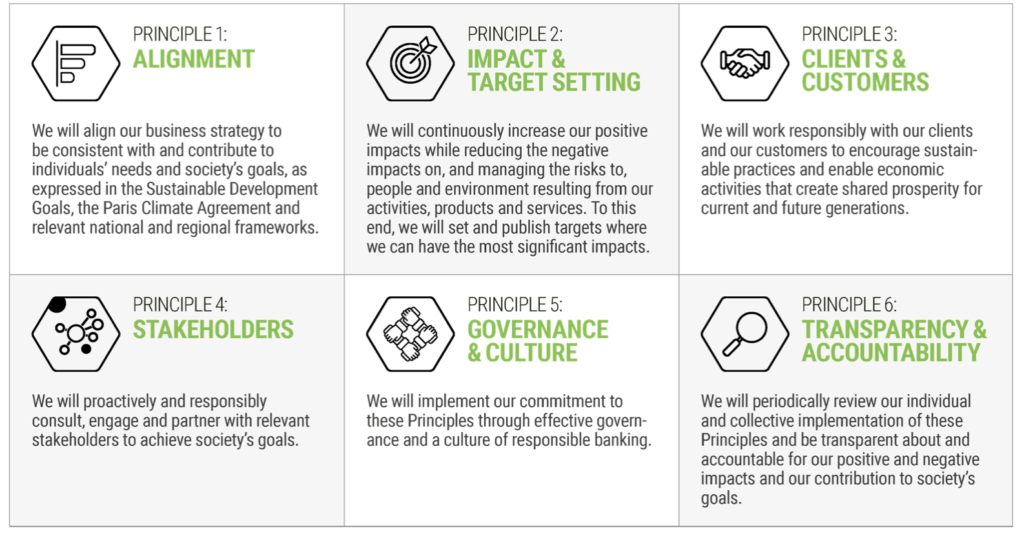

Basic Principles of Responsible Banking

Effects on International Markets

With many of the world’s largest banks volunteering for these new policies, it is likely there will be a shift in the way oil, gas, and coal companies are financed. The policies will now force bank executives to think of the impact their investments have on society and not just the corporation. Investors and analysts alike have been wondering when we would see a shift away from the oil and gas desk; maybe this is the first start of that shift. The hope is that these principles will encourage banks to shift portfolios from carbon-heavy companies and assets towards more green companies and assets. It will be interesting to see over this coming week how other big banks around the world react/ how these carbon-heavy companies stock prices are affected.